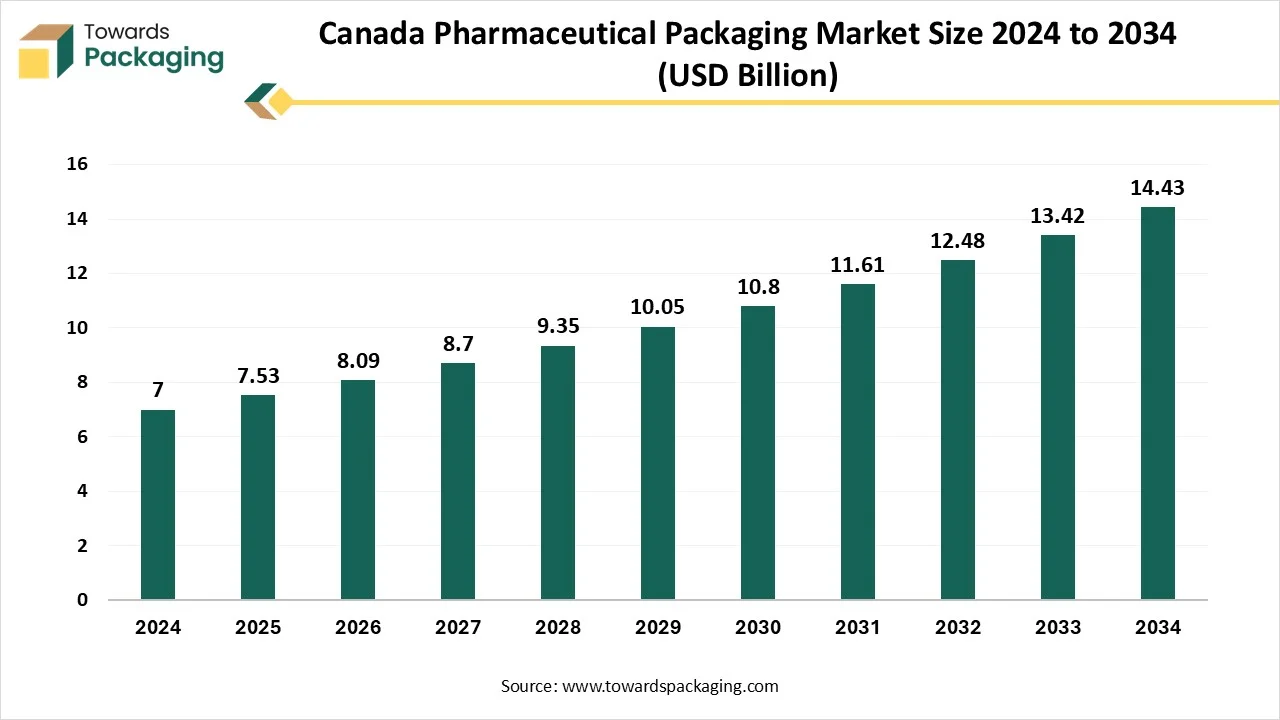

Canada Pharmaceutical Packaging Market Worth USD 14.43 Bn by 2034

According to a recent analysis by Towards Packaging, the global Canada pharmaceutical packaging market is projected to expand from USD 8.09 billion in 2026 to USD 14.43 billion by 2034, recording a CAGR of 7% between 2025 and 2034.

Ottawa, Sept. 30, 2025 (GLOBE NEWSWIRE) -- The global Canada pharmaceutical packaging market hit USD 7.53 billion in 2025, with current forecasts pointing to USD 14.43 billion by 2034, according to Towards Packaging, a sister firm of Precedence Research.

The market is experiencing steady growth, driven by increasing demand for innovative drug delivery systems, rising healthcare expenditures, and strict regulatory requirements for safe and efficient packaging. The growing adoption of sustainable packaging solutions, coupled with advancements in materials such as smart packaging and eco-friendly alternatives, is further shaping the market.

Get All the Details in Our Solutions - Access Report Sample: https://www.towardspackaging.com/download-sample/5698

What is Meant by Pharmaceutical Packaging?

Pharmaceutical packaging refers to the process and materials used to enclose and protect medicines, ensuring their safety, stability, and effectiveness until they reach the patient. It plays a critical role in preserving drug integrity by shielding products from physical damage, contamination, moisture, light, and other external factors.

Pharmaceutical packaging also includes labeling, which provides essential information such as dosage, usage instructions, batch numbers, and expiration dates, supporting patient safety and regulatory compliance. It encompasses primary packaging (direct contact with the drug), secondary packaging (protection and branding), and tertiary packaging (transportation and bulk handling).

What are the Latest Trends in the Canada Pharmaceutical Packaging Market?

-

Sustainability & Circular Economy

Growing regulatory and consumer pressure is prompting pharmaceutical companies to shift toward eco-friendly materials, including recyclable plastics, mono-materials, and compostable or biodegradable options. Companies are redesigning packaging to minimize plastic use, lightweighting, and phasing out multilayer non-recyclable materials. Closed-loop / reuse / refillable systems, as well as improved waste recovery, are being considered more seriously.

-

Smart / Active / Connected Packaging

Incorporation of features such as QR codes, RFID tags, tamper/freshness/temperature/moisture indicators for better traceability, authenticity, and condition monitoring. Active packaging elements (e.g., oxygen/moisture absorbers or sensors) to maintain stability of sensitive pharmaceuticals, especially biologics.

-

Rise of Specialty Drugs, Biologics, Prefilled Devices

Because biologics and biosimilars are more sensitive to light and temperature, the demand for packaging that offers more precise barrier properties and cold-chain capability is rising. Prefilled syringes, injectables, and self-injection devices are growing in adoption.

-

Patient-Centric Design

Packaging designed for safety and ease: child-resistant features, tamper-evident closures, and senior-friendly design (easy to open, clear labeling, larger fonts) are priorities. There is a greater focus on enhancing the user experience in handling, dosage, opening, and reading labels, among other aspects.

-

Regulatory & Labeling Changes

There are heightened requirements for traceability, serialization, and authentication to combat counterfeiting. Health Canada is developing updated guidance (for example, for co-packaged drug products) that may influence how packaging and labeling of combined or companion products are handled. Shifts toward digital documentation (e.g., XML product monograph filings) reflect a broader shift toward digital regulatory processes.

-

Materials & Format Innovation

Materials and format innovation is reshaping the market by introducing sustainable, tamper-evident, and smart packaging solutions that enhance drug safety and compliance. Regulatory demands, environmental concerns, and the need for improved patient engagement and supply chain efficiency drive these innovations. There is a rapid shift in packaging format, with formats such as pouches, soft packs, and lightweight containers gaining traction.

-

Temperature-Controlled & Cold-Chain Packaging

As more biologics, vaccines, and specialty drugs require strict thermal control, demand is increasing for packaging that can maintain a cold chain, with active/passive temperature control features.

-

Anti-Counterfeiting & Traceability Technologies

Anti-counterfeiting and traceability technologies are emerging as key trends in the market to combat the growing threat of counterfeit drugs. Solutions like serialization, QR codes, and blockchain are being adopted to ensure product authenticity, enhance supply chain transparency, and meet regulatory requirements.

-

Growth in Contract Packaging / Outsourcing

The growth in contract packaging and outsourcing is rising, driven by the need for cost efficiency, scalability, and faster time-to-market. Pharmaceutical companies are increasingly partnering with specialized contract packagers to access advanced technologies, meet regulatory standards, and focus on core R&D activities.

If there is anything you'd like to ask, feel free to get in touch with us @ sales@towardspackaging.com

What is the Potential Growth Rate of the Canada Pharmaceutical Packaging Market?

Shift Toward E-Commerce & Home Healthcare

The shift toward e-commerce and home healthcare is driving the growth of the market by increasing the need for safe, durable, and user-friendly packaging solutions. With more medicines being delivered directly to consumers, packaging must withstand transportation challenges, including handling stress, temperature variations, and potential tampering, while maintaining the integrity of the drugs. Home healthcare further demands packaging that is easy to open, senior-friendly, and includes clear dosage information for patient safety.

A notable 2025 development was the expansion of online pharmacies and home healthcare providers across Canada, which highlighted the rising need for innovative packaging designs with tamper-evident seals, sustainable materials, and smart labeling to ensure security, convenience, and compliance for patients receiving medications at home.

What are the Limitations & Challenges in the Canada Pharmaceutical Packaging Market?

Supply Chain Disruptions & Waste & Environmental Impact Concerns

Fluctuations in the prices of raw materials, such as plastics, polymers, glass, aluminum, and paper pulp, as well as delays or shortages in procurement, can cause cost overruns and delays. Also, disruptions in the global supply chain (especially for specialized components) are likely to hinder just-in-time operations. Moreover, single-use plastics and non-recyclable materials remain a significant concern. Growing regulatory and public pressure for sustainable packaging forces companies to invest in costly eco-friendly alternatives, which impacts profitability and slows market growth.

Country-Level Analysis:

Who is the leader in the Canada Pharmaceutical Packaging Market?

Ontario maintained a stronghold in the Canada pharmaceutical packaging market in 2024 due to several factors. Firstly, it has a large concentration of pharmaceutical manufacturers and contract packaging firms, which creates demand, economies of scale, and supply chain efficiencies. Secondly, the area benefits from a deep talent pool and strong research & development infrastructure, including universities, biotech clusters, and regulatory expertise. Geographic advantage plays a role: proximity to major domestic and U.S. markets supports logistics and distribution. Furthermore, Ontario’s government offers favourable policies and incentives for life sciences innovation, facilitating investment in advanced and sustainable packaging solutions.

Which Factors Make British Columbia the Fastest-Growing Area?

British Columbia is the fastest-growing area in the Canada pharmaceutical packaging market because of its rapidly expanding life sciences and biomanufacturing ecosystem. The province has been investing heavily in improving infrastructure, research labs, and incubators, while enhancing its skills base through new training centers, such as the BC National Biomanufacturing Training Centre.

Regulatory incentives and funding, both provincial and federal, support innovation and the development of green packaging. Moreover, BC has a dense network of startups, academic institutions, and centres of excellence in biotech and therapeutics, generating demand for advanced packaging solutions (such as biologics and smart packaging). Lastly, heightened consumer and regulatory pressure in BC for sustainable and ecological packaging drives material innovation.

More Insights of Towards Packaging:

- U.S. Pharmaceutical Packaging Market Drives at 7.36% CAGR (2025-34) - The global U.S. pharmaceutical packaging market is predicted to expand from USD 52.48 billion in 2025 to USD 99.44 billion by 2034.

- Insulated Packaging Market Drives at 6.8% CAGR (2025-34) - The global insulated packaging market size reached US$ 15.29 billion in 2023 and is projected to hit around US$ 31.53 billion by 2034.

- Healthcare and Laboratory Label Market Drives at 5.10% CAGR (2025-34) - The healthcare and laboratory label market is predicted to expand from USD 12.61 billion in 2025 to USD 19.73 billion by 2034.

- Pharmaceutical Plastic Packaging Market Driven by 6.6% CAGR (2025-34) - The pharmaceutical plastic packaging market size is predicted to expand from USD 62.43 billion in 2025 to USD 110.97 billion by 2034.

- Compound Pharmacy Packaging Market Size and Insights - The global compound pharmacy packaging market is booming, poised for a revenue surge into the hundreds of millions from 2025 to 2034.

- U.S. 503A Compounding Pharmacy Packaging Market Size and Insights - The U.S. 503A compounding pharmacy packaging market is booming, poised for a revenue surge into the hundreds of millions from 2025 to 2034.

- U.S. 503B Compounding Pharmacy Packaging Market Size and Insights - The U.S. 503B compounding pharmacy packaging market is accelerating, with forecasts predicting hundreds of millions in revenue growth between 2025 and 2034.

- Pressure-Sensitive Labelling Solutions for Pharmaceutical Market Size, Share & Growth Projections - The pressure-sensitive labelling solutions for pharmaceutical market is accelerating, with forecasts predicting hundreds of millions in revenue growth.

- Pharmaceutical Polymer Vials Market Growth, Innovations and Market Size Forecast 2034 - The pharmaceutical polymer vials market is booming, poised for a revenue surge into the hundreds of millions from 2025 to 2034.

- PCTFE Pharmaceutical Packaging Films Market 2025 Share, Trends, and Forecast at 5.3% CAGR to 2034 - The PCTFE pharmaceutical packaging films market is set to grow from USD 1000.35 million in 2025 to USD 1592.24 million by 2034.

- Pharmaceutical Sterile Sample Bags Market Report From USD 1.53 Bn in 2025 to USD 1.88 Bn by 2034 with Smart Packaging Growth - The pharmaceutical sterile sample bags market is projected to reach USD 1.88 billion by 2034, expanding from USD 1.53 billion in 2025.

- Reusable Cold Chain Packaging Market Trends 2025 Highlight Growth in Pharma E-commerce and IoT Integration - The global reusable cold chain packaging market is expected to grow from USD 4.97 billion in 2025 to USD 9.13 billion by 2034.

- Corrugated Packaging for Pharmaceutical Market Expansion 2025 Smart and Eco-Friendly Packaging Reshaping Pharma Logistics - The global corrugated packaging for pharmaceutical market is forecast to grow at a CAGR of 6.54%, from USD 9.12 billion in 2025 to USD 16.13 billion by 2034.

- France Pharmaceutical Packaging Market 2025 Boosted by R&D Growth and Green Regulations - The French pharmaceutical packaging market is expected to increase from USD 3.23 billion in 2025 to USD 6.12 billion by 2034.

-

PET Packaging in Pharmaceutical Market Trends 2025: Stretch Blow Molding and Blister Packs Propel Rapid Growth - The PET packaging in the pharmaceutical market is accelerating, with forecasts predicting hundreds of millions in revenue growth between 2025 and 2034.

Segment Outlook

Material Type Insights

The plastics segment dominated the Canada pharmaceutical packaging market in 2024 due to its cost-effectiveness, versatility, and reliable performance. Materials like polyethylene, polypropylene, and PET are widely used for bottles, vials, blister packs, and parenteral containers. Plastics offer excellent barrier properties, chemical resistance, and lightweight design, making them suitable for oral, liquid, and injectable drugs. Their adaptability allows customization for specific packaging needs, while scalable production ensures efficiency. These advantages, combined with durability and functional flexibility, make plastic the preferred material in pharmaceutical packaging across Canada.

The biodegradable & sustainable materials segment is expected to grow at the fastest rate in the coming years, driven by escalating environmental concerns and stringent regulations on plastic waste. Consumers are increasingly demanding eco-friendly packaging, prompting pharmaceutical companies to adopt biodegradable alternatives, such as plant-based polymers and compostable films. Government initiatives, including Extended Producer Responsibility (EPR) programs, further incentivize the shift towards sustainable materials. Technological advancements in biodegradable polymers and recyclable materials are also contributing to the market's rapid expansion.

Packaging Type Insights

The blister packs segment held the largest share of the Canada pharmaceutical packaging market due to several compelling factors. Blister packaging offers superior protection against moisture, light, and contamination, ensuring the integrity of pharmaceutical products. Its tamper-evident features enhance patient safety and comply with stringent regulatory standards. The format's suitability for unit-dose applications, such as tablets and capsules, aligns with the growing demand for precise dosing and convenience. Additionally, advancements in thermoforming and cold-forming technologies have improved production efficiency and cost-effectiveness, further solidifying blister packs' market leadership.

The prefilled syringes segment is expected to grow at the fastest rate during the forecast period, driven by several key factors. Advancements in polymer science and silicone alternatives have enhanced compatibility with sensitive biologics, addressing challenges in drug stability and patient safety. The shift towards home healthcare and self-administration has increased demand for user-friendly, ready-to-use delivery systems. Additionally, prefilled syringes reduce medication errors, minimize contamination risks, and streamline hospital workflows, aligning with healthcare priorities for efficiency and patient safety.

Join now to access the latest packaging in industry segmentation insights with our Annual Membership: https://www.towardspackaging.com/get-an-annual-membership

Drug Type Insights

The generic drugs segment led the Canada pharmaceutical packaging market in 2024 due to the expiration of patents on branded drugs, which has led to a surge in the availability of cost-effective generic alternatives. Government policies and supportive regulatory frameworks encourage the use and production of generics, while healthcare providers and patients increasingly prefer affordable medication options. Additionally, the rising prevalence of chronic diseases drives consistent demand for generics, reinforcing their prominence in the pharmaceutical packaging landscape across Canada.

The biologics & biosimilars is the fastest-growing segment in the market, driven by several key factors. Advancements in biotechnology have led to the development of complex biologic drugs, necessitating specialized packaging solutions to ensure their stability and efficacy. The expiration of patents for original biologics has paved the way for biosimilars, offering cost-effective alternatives that require similar, yet distinct, packaging considerations. Regulatory frameworks in Canada support the approval and integration of biosimilars, further fueling market growth. Additionally, the increasing prevalence of chronic diseases and the demand for personalized medicine contribute to the rising need for biologic and biosimilar therapies, thereby driving the demand for innovative packaging solutions.

Route of Administration Insights

The oral segment dominated the Canada pharmaceutical packaging market in 2024 due to its non-invasive nature, cost-effectiveness, and high patient compliance. Oral medications, such as tablets, capsules, and syrups, are easy to administer without the need for special training or professional supervision. This simplicity leads to widespread acceptance among patients, especially in outpatient and chronic care settings. The versatility of oral dosage forms in treating various medical conditions further strengthens their market position, ensuring accessibility and effectiveness in drug delivery.

The injectable segment is expected to experience rapid growth in the coming years. This is primarily due to the rising demand for biologics, vaccines, and treatments for chronic diseases. Specialized prefilled syringes, vials, and advanced tamper-evident packaging ensure sterility, safety, and ease of use, boosting patient compliance and market adoption.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardspackaging.com/schedule-meeting

Functionality Insights

The tamper-evident packaging segment dominated the Canadian pharmaceutical packaging market, holding the largest share in 2024. This is primarily due to strict regulations and the need to ensure product integrity and patient safety. Features such as destructible seals and shrink bands prevent contamination, counterfeiting, and misuse, thereby reinforcing trust in medications.

The temperature-controlled packaging segment is likely to expand at the fastest rate over the projection period, driven by the increasing demand for biologics, vaccines, and specialty drugs that require precise temperature management. Advancements in cold chain logistics and stricter regulatory standards further propel the adoption of temperature-controlled solutions. These innovations ensure the safety and efficacy of temperature-sensitive medications throughout the supply chain.

End-Use Insights

The pharmaceutical manufacturers segment dominated the Canada pharmaceutical packaging market in 2024 due to their central role in drug production and distribution. Manufacturers require extensive packaging solutions to ensure product safety, stability, and regulatory compliance across diverse dosage forms. Their focus on quality assurance, tamper-evident features, and labeling standards drives the adoption of advanced packaging technologies. Additionally, partnerships with contract packaging companies and investments in sustainable and temperature-controlled solutions further reinforce manufacturers’ influence, making them the primary drivers of innovation and growth in Canada’s pharmaceutical packaging sector.

The home healthcare providers segment is growing rapidly in the market due to an aging population and an increase in at-home care. The demand for user-friendly, portable, and secure packaging, such as prefilled syringes, tamper-evident seals, and child-resistant features, enhances patient compliance and ensures secure medication delivery, driving market expansion.

Access our exclusive, data-rich dashboard dedicated to the Canada Pharmaceutical Packaging Market - built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access Now: https://www.towardspackaging.com/contact-us

Recent Breakthroughs in the Market:

- In September 2025, Axium Packaging celebrated the opening of a new manufacturing plant in Brampton, Ontario, enhancing its capabilities to meet the growing demand for pharmaceutical packaging solutions across North America.

- In June 2025, CCL Healthcare launched Expanded Content Labels (ECLs), offering multilingual and regulatory information solutions to enhance patient safety and compliance in pharmaceutical packaging.

- In October 2024, Bayer introduced polyethylene terephthalate (PET) blister packaging for its Aleve brand, marking a significant step toward sustainability in the healthcare industry.

- In September 2024, at CPHI Milan 2024, Berry Global unveiled a new polypropylene (PP) alternative to PET pill jars, emphasizing patient-centric drug delivery solutions with improved environmental footprints.

Canada Pharmaceutical Packaging Market Players

- Amcor plc

- Gerresheimer AG

- West Pharmaceutical Services, Inc.

- AptarGroup, Inc.

- Schott AG

- Berry Global Inc.

- SGD Pharma

- CCL Industries

- Origin Pharma Packaging

- Constantia Flexibles

- Catalent Inc.

- Nipro Corporation

- Baxter International Inc.

- BD (Becton, Dickinson and Company)

- DWK Life Sciences

- PCI Pharma Services

- Tekni-Plex

- Rohrer Corporation

- Winpak Ltd.

- Tjoapack

Canada Pharmaceutical Packaging Market Segments

By Packaging Type

- Blister Packs

- Bottles & Containers

- Vials & Ampoules

- Pouches & Sachets

- Pre-filled Syringes

- Tubes

- Cartridges

- Wraps & Labels

By Material Type

- Plastics

- Glass

- Aluminium Foil

- Paper & Paperboard

- Biodegradable & Sustainable Materials

By Drug Type

- Branded Drugs

- Generic Drugs

- Over-the-Counter (OTC) Drugs

- Biologics & Biosimilars

By Functionality

- Child-Resistant Packaging

- Tamper-Evident Packaging

- Temperature-Controlled/Cold Chain

- Unit-Dose Packaging

- Bulk Packaging

By End-Use

- Pharmaceutical Manufacturing Companies

- Contract Manufacturing Organizations (CMOs)

- Hospitals & Clinics

- Retail Pharmacies

- Home Healthcare Providers

By Province/Region

- Ontario

- Quebec

- British Columbia

- Alberta

- Rest of Canada

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/price/5698

Become a Valued Research Partner with Us - Schedule a meeting: https://www.towardspackaging.com/schedule-meeting

Request a Custom Case Study Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

-

Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Towards Packaging, Your Trusted Research and Consulting Partner, Has Been Featured Across Influential Industry Portals - Explore the Coverage:

- Flexible Packaging Market - PACKNODE

- Is it finally safe to ditch your phone case? I put it to the test

- Battery Brands Charge Forward with Plastic-Free Packaging

- Why Non-corrugated Boxes Are the Future of Packaging

- Ampoules Packaging Market Size Expected to Reach $11.27 Bn by 2034

- Flexible plastic pouches projected to boom over the next decade

- GLOBAL PET FOOD PACKAGING MARKET SET TO DOUBLE BY 2032

- The Skinny on the Skin Packaging Market

- Healthcare Goes Green & Sterile

- The Different Types of Adhesives for Paper Packaging

-

Child-Resistant Packaging: Cannabis and So Much More

Towards Packaging Releases Its Latest Insight - Check It Out:

- UAE Ampoules Packaging Market 2025: Growth Boosted by Smart Packaging & Pharmaceutical Surge

- Disc Top Caps Market to Witness Robust Growth by 2034 | Personal Care & Pharma Packaging Demand Surges

- Pharmaceutical Tube Packaging Market Growth Fueled by AI, Personalized Medicine & Clean Label Trends

- Pharmaceutical Packaging Machines Market Driven by AI, Smart Tech, and USD 13.63 Billion Forecast

- Smart Containers Market Enhance Cold Chain Safety in Food & Pharmaceuticals

- Cell Culture Media Storage Containers Market Set to Triple by 2034: AI and Biopharma Drive Demand

- CDMO Packaging Market Set to Soar in 2025 as Pharma Outsourcing and Biologics Drive Explosive Growth

- Sustainable Pharmaceutical Packaging Market Growth, Innovations, and Market Size Forecast 2034

- Aseptic Packaging for the Pharmaceutical Market Size, Trends, Share, and Innovations 2034

- Pharmacy Repackaging System Market 2025: Smart Packaging Meets Compliance in a Digital Healthcare

- Pharma Blister Packaging Machines Market Drives at 2.85% CAGR

- Pharmaceutical Stand Up Pouches Market Growth Drivers, Challenges and Opportunities

- PTP Aluminum Foil for Pharmaceutical Package Market Insights, Trends and Forecast

- Pharmaceutical Cold Chain Logistics Packaging Market Size & Growth Forecast 2034

-

Pharmaceutical APET Film Market Research, Consumer Behavior, Demand and Forecast

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.